3 steps to readying your business for economic nexus

It took 26 years for the Commerce

Clause to catch up with ecommerce. On June 21, 2018, the Supreme Court ruled in the case of South Dakota v. Wayfair, giving way for states to impose sales

tax on remote sellers: https://www.avalara.com/us/en/learn/sales-tax/South-

Dakota-Wayfair/get-prepared.html based on economic nexus (the volume or dollar value

of sales into

a state) and

not just physical presence.

Settling the debate

took years, but requiring companies to comply will likely come much faster. And it’s not just Internet retailers that need to pay heed to tax rule changes. Any business in any industry that sells to or services out-of-state customers, online or offline, could be on the hook for sales tax under economic nexus.

Here

are three actions every tax manager, finance leader, and business owner should

take to prepare:

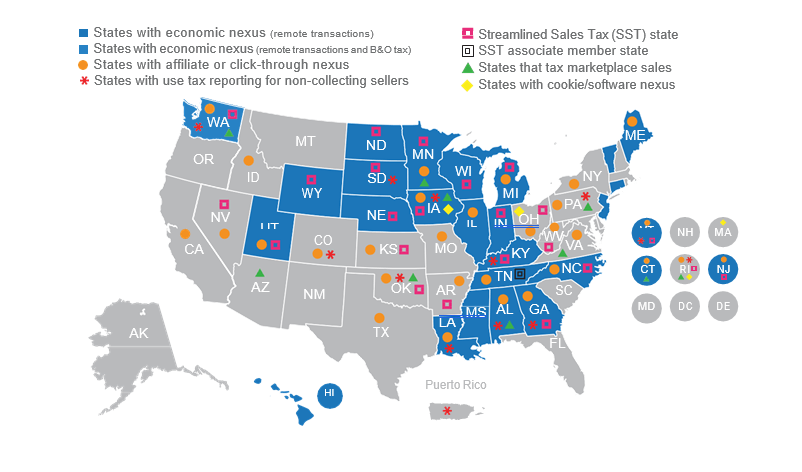

1. Reassess Nexus: Where are your current (and future) customers?

Why it’s time: Now that the Supreme Court

has given the green light

to one state to collect

sales tax on remote

sales, others are undoubtedly following suit. Already, more than 20 states have economic

nexus laws in place or pending (see map). What that means is

that, in addition

to states where

you have physical

presence nexus,

you could be required

to collect and remit sales

tax on sales into states where you

meet the minimum

thresholds for

economic nexus: https://www.avalara.com/us/en/learn/sales-tax/South-Dakota-Wayfair.html either based

on volume of sales or total revenue from those sales.

The Bottom

Line: If you are uncertain of your nexus

obligations or want to be extra sure your business

is compliant under

the new economic nexus regulations,

consider a nexus analysis

study: https://www.avalara.com/us/en/products/professional-services/ NexusAnalysisStudy.html.

2. Revisit

Registration: Will you now need to collect and remit sales tax in more states?

Why it’s time: If your sales

activities give you nexus in more states,

you’ll need to register

to collect sales

tax, remit tax, and file sales

tax returns in those states.

How and when you

need to file

returns and remit sales

tax can be drastically different from state-to-state. Keeping on

top of your obligations with the additional burden of economic nexus

could become a challenge to manage manually

or with in-house staff.

The Bottom

Line: Consider the benefits

of having a third-party handle

registration and returns for you. Avalara

has a full suite of technology solutions

that address every stage of tax compliance from accurate

rate calculation to on-time returns

filing to business license and tax registration services: https://www.avalara.com/us/en/products/professional-services.html.

3.

Rethink

Compliance: Is there a better way?

Why it’s time: How you manage

sales tax and

use tax today

may not be enough to keep you compliant once states start expanding and enforcing economic nexus. If the company is growing or planning to grow, its tax obligations will likely grow too. If your financial systems aren’t optimized for tax changes

of this magnitude or you are too

reliant on staff

to keep you compliant, the company could

be at greater risk for errors or audits.

The Bottom Line:

Having a robust and reliable sales

tax solution in place today

prepares you to deal with any and all tax obligations that impact your business now or in the future.

Check out Avalara’s cloud software solutions: https://www.avalara.com/us/en/products/sales- and-use-tax.html, which offer unparalleled accuracy

and reliability and turn-key set up in your current

ERP, ecommerce or accounting system.

Rest Easy. Sales tax is complicated. And it’s not likely to get easier

anytime soon. But that doesn’t

mean it has to eat up resources and be a burden

on the business. Explore the benefits of tax automation. Ask your platform

provider about Avalara or talk to one of our tax automation specialists. There’s peace of mind in knowing you’re doing

sales tax right…no

matter which way the gavel

falls.

About Avalara

Avalara helps businesses of all sizes achieve compliance with transaction taxes, including sales and use, VAT, excise, communications, and other tax types. The company

delivers comprehensive, automated, cloud-based solutions designed

to be fast, accurate, and easy to use. The Avalara Compliance Cloud® platform helps

customers manage complicated and

burdensome tax compliance obligations imposed by state, local,

and other taxing

authorities throughout the

world.

Avalara offers

more than 600 pre-built connectors into leading accounting, ERP, ecommerce and other business

applications, making the integration of tax and compliance

solutions easy for customers. Each year, the company

processes billions of indirect tax transactions for customers and users, files

more than a million tax returns, and manages millions of tax exemption

certificates and other compliance documents.

Recent Comments