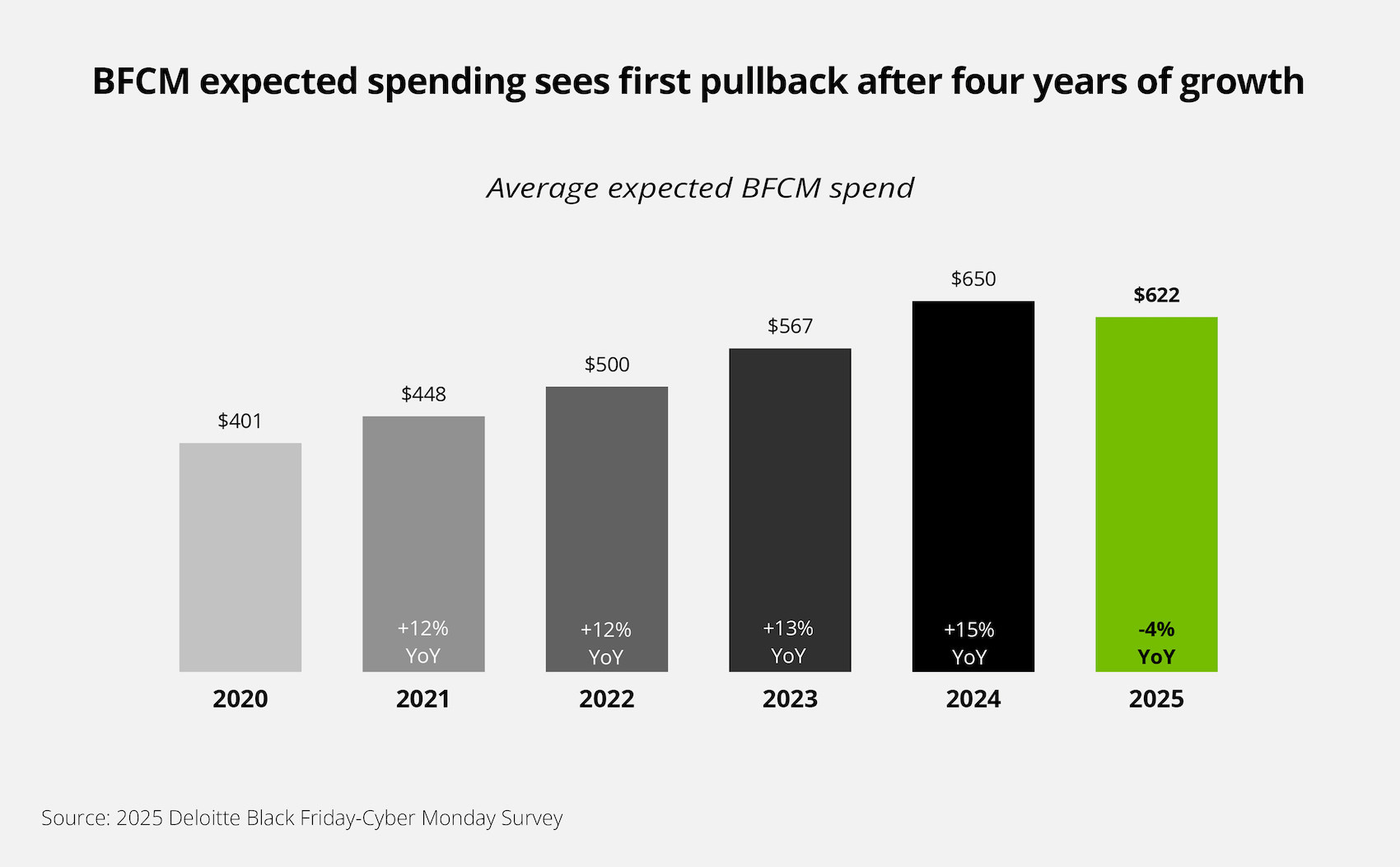

HUDSON YARDS, N.Y. – Deloitte’s “2025 Black Friday-Cyber Monday Survey” revealed that consumers plan to spend an average of $622 during Black Friday-Cyber Monday (BFCM) shopping events (Thursday, Nov. 27 – Monday, Dec. 1), down 4% from last year. Year-over-year participation in BFCM is up slightly, with 82% of respondents planning to shop during the week. This year, while many plan to cut back amid financial concerns, value is motivating more shoppers to make the most of the holiday week, both online and in-store.

Nearly two-thirds of shoppers surveyed (64%) plan to use financing options to stretch their BFCM budgets, which remains in line with last year’s findings. While BFCM has evolved into a hybrid event, 72% of Gen Z shoppers plan to shop in store on Black Friday, compared to 49% of all shoppers.

The BFCM period continues to spark joy as shoppers leverage the promotional period to stretch their holiday budgets. This comes as 61% of shoppers surveyed plan to take advantage of as many deals as possible.

Key Findings

BFCM continues to make the list: 82% of surveyed consumers plan to shop BFCM this year, up from 79% in 2024. The overall participation rate is even higher among Gen Z shoppers (92%).

- After four years of growth, spending is expected to decline 4% to an average of $622. Among surveyed shoppers planning to spend less, the primary drivers are the higher cost of living (69%) and financial constraints (43%).

- Gen Z and millennial shoppers surveyed plan to keep their spending flat while Gen X and Boomers plan to reduce their spending by 9% and 12% respectively, year-over-year. Additionally, 56% of Gen Z respondents say they plan to cut back on other expenses to spend during BFCM, versus 41% of others.

- Lower- and higher-income households signal cutbacks: Those making less than $50K and those making $200K or more plan to spend 12% and 18% less, respectively, year-over-year. Only those making $100K-199K per year say they plan to spend more, an increase of 5% year-over-year.

“This season, consumers are eager to find the best deals to wrap up their holiday shopping,” wrote Deloitte researchers. “They have made their gift lists and are checking Black Friday-Cyber Monday promotions to stretch their budgets. While we expect shoppers to plan to pull back on spending, we also anticipate strong participation throughout the holiday week, with many planning to blend the convenience of online shopping with the energy of the in-store experience. This highlights the importance for retailers to deliver a smooth, connected experience no matter where people choose to spend their holiday dollars.”